EMV and Chargebacks |

Face to face merchants that have not yet upgraded to EMV | Chip enabled devices are experiencing a higher number of chargebacks. The liability shift that took effect October 1, 2015 from the issuing bank to the merchant, ensures a full loss to the merchant on chargebacks that were processed due to NON-EMV equipment. There is no recourse. That money is gone.

A chargeback occurs when a customer contacts a credit card Issuing Bank to initiate a refund for a purchase they made on their credit card. The reasons why chargebacks arise can vary greatly but generally, they are the result of a customer being dissatisfied with their purchase, a customer not having authorized the transaction or a customer reporting a fraudulent transaction. An unauthorized transaction could be a result of a duplicate processing, misunderstanding of the price, deposit, return or refund policies between the customer and the merchant.

A chargeback occurs when a customer contacts a credit card Issuing Bank to initiate a refund for a purchase they made on their credit card. The reasons why chargebacks arise can vary greatly but generally, they are the result of a customer being dissatisfied with their purchase, a customer not having authorized the transaction or a customer reporting a fraudulent transaction. An unauthorized transaction could be a result of a duplicate processing, misunderstanding of the price, deposit, return or refund policies between the customer and the merchant.

*Visa Chargeback Management Guidelines

MerchantConnect Premium with Online Case Management (OCM)

MerchantConnect Premium with Online Case Management (OCM) provides the same reporting capabilities as MerchantConnect Premium with the added abilty to view, manage, report and respond to chargeback and retrieval disputes online.

Online Case Management provides detailed chargeback and retrieval information to your dispute management representatives based on a variety of user-defined queue attributes. Users can view case information, original transaction history, documentation shared between the card issuer, acquirer and merchant, case history, user notes indicating progress on the research performed and respond to the case using optional user-defined response templates and rules. Upon responding a confirmation of acquirer receipt is received near real-time. E-mail alerts can be enabled to notify your users of important changes in the status of a case, such as when a case reaches an aging milestone or new information is received. Additionally sophisticated search capabilities allow users to pull on demand reports providing case information for up to 2 years.

MerchantConnect Premium with Online Case Management provides a streamlined approach to managing your transaction level activity. From reporting of transactions to dispute management of chargebacks and retrievals, this option will enable your users to manage electronic credit card processing activity as it moves through the various cycles, improving efficiency and reducing costs such as paper for printing, telecommunication costs via facsimile, data storage costs through email or sFTP or mail costs via US Postal Service.

Online Case Management | Video Links Below

- OCM Introduction | DEMO

- View Open Cases | DEMO

- Responding to Cases | DEMO

- Searching for Cases | DEMO

- Generating Reports | DEMO

Preventing and Reducing Chargebacks

The customer may or may not have contacted the merchant about remedying this situation ahead of time. They may even be completely wrong. However, responsibility falls to the seller to ensure that the transaction goes smoothly and the customer is satisfied. A failure somewhere within the fulfillment process, including at the customer service level, can lead to a chargeback.

Preventing Chargebacks

The best way to deal with any chargeback is to prevent it from happening in the first place. The following suggestions are very generic and can be used by most businesses to decrease their chargeback potential.

- Use a clear DBA (Doing Business As) name that customers will recognize. Vague corporate names that do not accurately describe what your company might do or sell will only confuse customers when they review their billing statements. An unrecognized DBA name on billing statements is one of the most common causes of chargebacks.

Put your phone number on your customers’ statements. If they do not recognize your DBA, they can call you to find out who you are and why you charged them. - Always respond to a chargeback as quickly as possible. A limited amount of time (10 business days) is available to resolve a chargeback. If you miss the window of opportunity to respond, you forfeit your ability to fight the chargeback.

- Never accept an expired credit card. Obtain authorization for the full amount of the sale. Declined transactions should not be accepted or split into smaller amounts.

- Some disputes are not the result of unauthorized credit card use. Rather, they start because the customer disputes the quality of the goods or services purchased. The best way to avoid this type of chargeback is to work closely with the customer to establish a mutually satisfactory solution.

- Verify the customer’s address. It is possible to verify the customer’s name, address and phone number with the card Issuing Bank. By calling the Voice Authorization Center for address verification, you can verify the address and also provide proof that you verified the address.

- Always get signed proof of delivery. Be able to provide a shipping tracer log that shows that the customer received the shipped goods.

- Charge the customers account at the time the goods are shipped. If you know there will be a delay in delivery, wait to process your customer’s credit card.

- Be suspicious of high-ticket sales requested to be sent next-day air or if a runner will be in to pick up the purchase at a later time.

- Use the fraud services offered by the Processing Bank including AVS (Address Verification) and CVV2.

Have your return/refund policy clearly stated at your retail checkout and on your Website. Make it a requirement that customers read and sign the policy before their order can be processed as you need to be able to prove the customer saw the policy. - Provide accurate descriptions and images of your products on your Website if you are an online retailer.

Be very cautious of any foreign orders. Generally, orders from Asia, the Middle East, and most parts of Africa are considered high-risk. - Be wary of orders with domestic billing addresses and foreign shipping addresses. They are usually fraudulent.

- Be wary of orders for which the customer is willing to pay more for faster delivery.

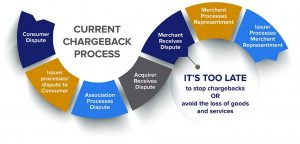

Chargeback Process

The customer disputes a transaction by contacting their card Issuing Bank. The card Issuing Bank researches to determine whether the reasoning for the chargeback is valid. If not, the chargeback is declined and the customer is held responsible for the charge.

The customer disputes a transaction by contacting their card Issuing Bank. The card Issuing Bank researches to determine whether the reasoning for the chargeback is valid. If not, the chargeback is declined and the customer is held responsible for the charge.

A provisional credit is provided to the customer. The card Issuing Bank initiates a chargeback process and obtains credit from the merchant’s Processing Bank.

The merchant’s Processing Bank researches the validity of the chargeback. If they determine the chargeback is invalid, they will decline the chargeback and return it to the card Issuing Bank. The chargeback amount is removed from the merchant’s account and the merchant’s Processing Bank provides written notification to the merchant.

Did a processing error occur? If so, the sale is re-presented to the card Issuing Bank for corrections.

The merchant provides documentation to remedy the chargeback. If the provided documentation is found to be satisfactory, the chargeback is declined and the customer is once again charged for the sale. If the documentation is found to be unsatisfactory, the chargeback is successful and the process ends.

There are multiple steps involving multiple parties and each step requires the responsible party to dedicate a certain amount of time to its management. The resolution of a typical chargeback can take anywhere from six weeks to six months.

Chargeback Reasons

Common chargebacks in a card-not-present environment (some of these reasons may be exclusive to POS or MO/TO merchants).

1. Fraud – Card Present Environment

Merchant completes a transaction without the cardholder’s permission, or a fictitious account number is used and the transaction receipt bears no valid account number.

Codes

- Visa | 81 Fraud – Card Present Transaction

- MasterCard | 4837 No Cardholder Authorization

- Discover| UA01 Fraud – Card Present Transaction

Tips | If the card was swiped through a magnetic-stripe reader, request that your acquirer send a copy of the authorization record to the card issuer as proof that the card’s magnetic-stripe was read.

If a manual imprint of the card account information was made on the transaction receipt, send a copy of the transaction receipt to your acquirer as documentation. The copy of the transaction receipt should also contain the cardholder’s signature.

Note

Card imprint requirements only apply if the terminal is not chip-enabled. If a chip card was manually keyed at a chip-enabled terminal, the transaction is considered a fallback and, if authorized by issuer, is not eligible for chargeback.

2. Cancelled recurring transaction

Merchant continues to charge a cardholder’s account for recurring transaction after receiving a notice of cancellation.

Codes

- Visa | 41 Cancelled Recurring Transaction

- MasterCard | 4841 Cancelled Recurring Transaction

- Discover | AP Recurring Payments

Note

For merchants with variable recurring transaction amounts. When you set up the customer’s recurring billing, you should have disclosed that this charge would be for a variable amount and permitted the cardholder to set a range of approved charges. If a charge exceeded this amount and you did not notify the cardholder in advance, they are able to successfully dispute the charge using the above reason code. If the customer disputed the charge using that reason code, we recommend you contact the cardholder directly to obtain payment and determine if this recurring service should be cancelled.

Tips | Provide the documentation by the due date to preserve your rights.

Represent the chargeback regardless of whether the customer states they will cancel the chargeback (to preserve your rights). Issue credits to the account used in the purchase and not by check or money order.

3. Service not provided or merchandise not received

Cardholder acknowledges participating in the transaction and claims one of the following occurred:

- Cardholder did not receive merchandise or other item of value that was shipped.

- Merchant was unwilling or unable to provide purchased services.

- Services were paid for using another method.

- Cardholder did not receive merchandise at the agreed upon location or by the agreed upon delivery date.

If the credit issued was a partial credit, be sure to include an explanation as to why full credit was not issued.

Codes

- Visa | 30 Services Not Provided or Merchandise Not Received

- MasterCard | 4855 Goods or Services Not Provided

- Discover | RG Non-Receipt of Goods or Services

Tips | If available, provide a signed delivery receipt or similar document by the due date to preserve your rights.

Represent the chargeback regardless of whether the customer states they will cancel the chargeback (to preserve your rights). Issue credits to the account used in the purchase and not by check or money order.

4. Defective Merchandise

Cardholder claims that the good received were defective or not as described by merchant.

Codes

- Visa | 53 Not As Described or Defective Merchandise

- MasterCard | 4853 Cardholder Dispute-Defective/Not as Described

- Discover | RM Cardholder Disputes Quality of Goods or Services

Tips | If the merchandise was as described, provide your acquirer with specific information and invoices to refute the cardholder’s claims.

5. Duplicate processing

A single transaction was presented two or more times to the issuer for the same cardholder account number, similar transaction amounts and similar clearing data. If the same transaction was processed by different acquirers, the issuer is required to dispute the transaction that posted last.

Codes

- Visa | 82 Duplicate Processing

- MasterCard | 4834 Duplicate Processing

- Discover | DP Duplicate Processing

Tips | Provide two different signed receipts or invoices. If sales receipt does not contain detail of items purchased, include an itemized list. For Contactless and Small Ticket transactions, signatures are not required just detail of what was purchased.

6. Fraudulent multiple transactions

The issuer receives a written complaint from its cardholder who acknowledges participation in at least one transaction at the same merchant location where the other transaction(s) allegedly involving the cardholder took place, but states that:

He/she neither participated in nor authorized the other transaction(s), and

The card was in his/her possession at the time(s) of the other transaction(s).

Codes

- Visa | 57 – Fraudulent Multiple Transactions | 62 – Counterfeit Transaction | 83 – Fraud – Card Absent Transaction | 93 – Merchant Fraud Performance Program

- MasterCard | 4837 – No Cardholder Authorization | 4840 – Fraudulent Processing of Transactions | 4849 – Questionable Merchant Activity | 4870 – Chip Liability Shift | 4871 – Chip/PIN Liability Shift

- Discover | UA02 – Fraud – Card Not Present Transaction

Tips | Always keep a copy of the signed sales draft and or invoices for all transactions that the cardholder participated in, provide to the issuer when requested.

7. No authorization

Transaction exceeds the floor limit and an authorization was not obtained on the transaction, or transaction is an online check card transaction or an original adjustment.

Codes

- Visa | 70 – Card Recovery Bulletin or Exception File | 71 – Declined Authorization | 72 – No Authorization | 73 – Expired Card | 78 – Service Code Violation

- MasterCard | 4807 – Account Closed and No Authorization Obtained | 4808 – Requested/Required Authorization Not Obtained | 4812 – Account Number Not on file

- Discover | AT – Authorization Non Compliance

Tips | Authorization code along with date and amount of authorization, if other than the transaction date and amount.

8. Incorrect transaction amount or account number

Used under any of the following circumstances:

- Merchant processed an incorrect transaction amount.

- Merchant processed an account number that did not match the one on the transaction receipt.

- Cardholder’s transaction receipt contains an addition or transposition number.

- Transaction receipt was altered without cardholder’s permission

Codes

- Visa | 80 Incorrect Transaction Amount or Account Number

- MasterCard | 4831 Transaction Amount Differs

- Discover | AW Altered Amount

Tips | A signed sales receipt with imprint or swipe to show that cardholder agreed to the amount or that card number was correct. A written rebuttal is required if amount was altered after cardholder signed the receipt.

9. Fraudulent transaction – Card-not-present environment

A transaction was processed in a card-not-present environment without the cardholder’s permission or with a fictitious account number.

Codes

- Visa | 83 Fraud – Card Absent Transaction

- MasterCard | 4837 No Cardholder Authorization

- Discover | UA02 Fraud – Card Not Present Transaction

Tips | Invoice with ship to/bill to addresses, AVS results, CVV2 results if applicable, and signed proof of delivery.

If T&E, proof that the sale was a properly processed “no show” transaction.

10. Credit not processed

The merchant issued a credit transaction receipt or refund acknowledgement but the transaction was not processed through interchange. The cardholder returned merchandise or cancelled a sale but did not receive a credit receipt or refund acknowledgement.

Codes

- Visa | 85 Credit Not Processed

- MasterCard | 4860 Credit Not Processed

- Discover | RN2 Credit Not Processed

Tips | A written rebuttal addressing the cardholder’s claim and any supporting documentation to prove the case, such as a signed contract or return policy.