Streamline Processes and Increase AP Controls with Buyer-Initiated Payments

If your goal is to automate and initiate payments directly to your suppliers — streamlining the process for all parties — then you need EC-Pay, 3DSI’s buyer-initiated payment system (also known as push pay). Using the traditional credit card processing networks, this end-to-end commercial payments system puts you in control of your payments while simplifying and expediting the process for both you and your suppliers.

With EC-Pay, you decide when an invoice is paid, initiating and processing payments by purchasing card (P-card) when you’re ready. No action is required by your suppliers to receive payment, and you never have to share your card number with them. Plus, the amount on the invoice will always match the amount of the payment because you control the transaction. And each transaction contains remittance details and payment notification for your suppliers.

Plus, buyer-initated payments qualify for the lowest available commercial card interchange rates, making this payment type much more appealing to your suppliers.

EC-Pay integrates with your existing ERP and accounting system, such as SAP, Oracle, Microsoft, JD Edwards and more. And we can even handle vendor outreach and enrollment on your behalf.

Benefits

Processes all major card brands. Visa, MasterCard, American Express, Discover, Diners Club, JCB

Flexible design and easy implementation.

- Integrates with existing ERP and accounting systems, such as SAP, Oracle, Microsoft, JD Edwards and more.

- No need to install new applications or purchase new hardware.

- Requires no extensive training.

Superior payment security.

- Meets requirements as a Certified Payment Provider under the Payment Card Industry Data Security Standard (PCI DSS).

- Provides secure SSL and FTP encryptions.

- Stores credit card data in our world-class data centers (with CardVault® option).

Enhanced security option through CardVault.

- Provides innovative credit card tokenization and storage.

- Removes risk of storing credit card data on your internal systems.

- Ensures your sensitive data is not exposed to suppliers.

Saves time and money.

- Allows you to improve accountability and reconciliation processes when Level-3 data is provided back to you from the card-issuing bank.

- Earns revenue share for your organization through rebates from your issuing bank (if revenue sharing is offered).

- Saves time through greater automation of purchase orders and more efficient invoice management.

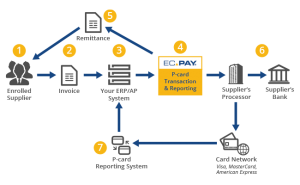

How it works

- A supplier (who is enrolled to receive P-card payments on the 3DSI platform) submits an invoice to your AP dept.

- The invoice is approved through your normal process.

- In your ERP/AP system, you initiate payment instructions to 3DSI’s EC-Pay service.

- EC-Pay submits the P-card payment to the supplier’s card processor in real time.

- EC-Pay also sends an electronic remittance to your supplier.

- The supplier’s processor deposits funds into the supplier’s bank account while the card networks process the transaction.

- Your card issuer’s P-card reporting system receives the fully processed transaction and typically sends a transaction report to your ERP/AP system, positively closing the payment loop.

Bonus: All parties can make use of the Level-3 line item detail capabilities of the EC-Pay system to ensure transaction accuracy and reconciliation capability.